- Browse

- Taxation

Taxation Courses

Taxation courses can help you learn tax compliance, income tax preparation, corporate taxation, and international tax law. You can build skills in tax planning, understanding deductions and credits, and navigating tax regulations effectively. Many courses introduce tools like tax software, spreadsheets for financial analysis, and resources for staying updated on tax legislation, that support applying your knowledge in practical work.

Popular Taxation Courses and Certifications

Status: Free TrialFree TrialP

Status: Free TrialFree TrialPPwC India

Skills you'll gain: Sales Tax, Tax, Tax Compliance, Tax Laws, Invoicing, Regulatory Compliance, Registration, Problem Solving

4.5·Rating, 4.5 out of 5 stars81 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Pennsylvania

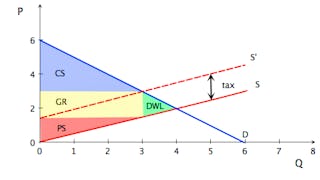

Skills you'll gain: Supply And Demand, Economics, Market Dynamics, Market Analysis, Resource Allocation, Policy Analysis, Tax, Consumer Behaviour, Cost Benefit Analysis, Decision Making

4.8·Rating, 4.8 out of 5 stars1.7K reviewsMixed · Course · 1 - 3 Months

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Fund Accounting, Governmental Accounting, Financial Reporting, Non-Profit Accounting, Accounting, Generally Accepted Accounting Principles (GAAP), General Ledger, Financial Statements, Cash Flows, Accrual Accounting, Revenue Recognition, Depreciation, Reconciliation, Budgeting, Accountability

4.8·Rating, 4.8 out of 5 stars10 reviewsIntermediate · Course · 1 - 3 Months

Status: Free TrialFree Trial

Status: Free TrialFree TrialSkills you'll gain: Export Control, Tax, Tax Laws, Commercial Laws, Tax Compliance, Transportation Operations, Policy Development, Public Policies, Law, Regulation, and Compliance, Problem Solving

4.8·Rating, 4.8 out of 5 stars10 reviewsBeginner · Course · 1 - 4 Weeks

Status: Free TrialFree TrialT

Status: Free TrialFree TrialTTechnical University of Munich (TUM)

Skills you'll gain: Income Statement, Inventory Accounting, Profit and Loss (P&L) Management, Cost Accounting, Gross Profit, Management Accounting, Financial Accounting, Financial Statements, Inventory Management System, Operating Expense

4.7·Rating, 4.7 out of 5 stars90 reviewsIntermediate · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Supply And Demand, Market Dynamics, Economics, Business Economics, Cost Accounting, Consumer Behaviour, Tax, Price Negotiation, Resource Allocation

Build toward a degree

4.8·Rating, 4.8 out of 5 stars2.5K reviewsIntermediate · Course · 1 - 4 Weeks

A

AAlfaisal University | KLD

Skills you'll gain: Standard Accounting Practices, Accounting, Financial Statements, General Accounting, Financial Reporting, Bookkeeping, Generally Accepted Accounting Principles (GAAP), Financial Accounting, International Financial Reporting Standards, Income Statement, Balance Sheet

4.8·Rating, 4.8 out of 5 stars87 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewA

Status: PreviewPreviewAAlfaisal University | KLD

Skills you'll gain: Financial Policy, Public Administration, Economics, Policy, and Social Studies, Economic Development, Economics, Budgeting, Fiscal Management, Public Policies, Policy Analysis

4.5·Rating, 4.5 out of 5 stars8 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewA

Status: PreviewPreviewAAlfaisal University | KLD

Skills you'll gain: Cash Flows, Loans, Deposit Accounts, Financial Planning, Fraud detection, Banking Services, Budgeting, Financial Acumen, Financial Management, Personal Development, Banking, Expense Management

4.9·Rating, 4.9 out of 5 stars163 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewA

Status: PreviewPreviewAAlfaisal University | KLD

Skills you'll gain: Financial Analysis, Business Planning, Financial Statements, Financial Acumen, Cost Management, Profit and Loss (P&L) Management, Financial Reporting, Financial Management, Accounting

4.9·Rating, 4.9 out of 5 stars80 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewA

Status: PreviewPreviewAAlfaisal University | KLD

Skills you'll gain: Business Valuation, Financial Analysis, Financial Statements, Investment Management, Business Analysis, Financial Forecasting, Competitive Analysis, Financial Modeling, Risk Analysis

4.7·Rating, 4.7 out of 5 stars9 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewA

Status: PreviewPreviewAAlfaisal University | KLD

Skills you'll gain: Working Capital, Financial Analysis, Financial Management, Budget Management, Investment Management, Risk Management, Return On Investment, Risk Analysis, Financial Modeling, Cash Management, Business Metrics

4.7·Rating, 4.7 out of 5 stars40 reviewsBeginner · Course · 1 - 4 Weeks

In summary, here are 10 of our most popular taxation courses

- GST - Genesis and imposition!: PwC India

- Microeconomics: The Power of Markets: University of Pennsylvania

- Governmental Accounting and Reporting I : University of Illinois Urbana-Champaign

- Introduction to Customs and Foreign Trade Policy: PwC India

- Cost Accounting: Profit and Loss Calculation: Technical University of Munich (TUM)

- Firm Level Economics: Consumer and Producer Behavior: University of Illinois Urbana-Champaign

- مبادئ وأساسيات المحاسبة | What Accounting is all about: Alfaisal University | KLD

- الدين الحكومي وعجز الموازنة : Alfaisal University | KLD

- الثقافة المالية | Financial Literacy: Alfaisal University | KLD

- المالية لغير الخبراء الماليين: Alfaisal University | KLD