Depreciation

Filter by

SubjectRequired *

LanguageRequired *

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired *

LevelRequired *

DurationRequired *

SubtitlesRequired *

EducatorRequired *

Results for "depreciation"

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Cash Flows, Financial Accounting, Financial Statements, Fixed Asset, Financial Reporting, Financial Analysis, Depreciation, Balance Sheet, Equities, Accounting

Build toward a degree

4.7·Rating, 4.7 out of 5 stars1.8K reviewsIntermediate · Course · 1 - 3 Months

Status: NewNewStatus: PreviewPreview

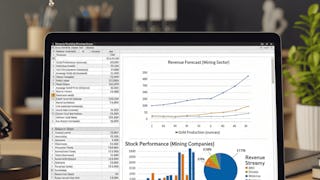

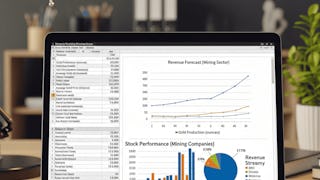

Status: NewNewStatus: PreviewPreviewSkills you'll gain: Financial Modeling, Balance Sheet, Financial Statement Analysis, Financial Statements, Revenue Forecasting, Depreciation, Capital Expenditure, Financial Analysis, Financial Forecasting, Business Valuation, International Finance, Working Capital, Business Metrics, Equities, Cash Flows, Forecasting

5·Rating, 5 out of 5 stars9 reviewsMixed · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Pennsylvania

Skills you'll gain: Return On Investment, Capital Budgeting, Finance, Capital Expenditure, Forecasting, Cash Flow Forecasting, Financial Modeling, Financial Analysis, Cost Benefit Analysis, Financial Management, Financial Acumen, Corporate Finance, Business Valuation, Cash Flows, Risk Analysis, Depreciation, Loans, Working Capital

4.6·Rating, 4.6 out of 5 stars6.3K reviewsMixed · Course · 1 - 4 Weeks

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Fund Accounting, Governmental Accounting, Financial Reporting, Non-Profit Accounting, Accounting, Generally Accepted Accounting Principles (GAAP), General Ledger, Financial Statements, Cash Flows, Accrual Accounting, Revenue Recognition, Depreciation, Reconciliation, Budgeting, Accountability

4.8·Rating, 4.8 out of 5 stars9 reviewsIntermediate · Course · 1 - 3 Months

Status: NewNewStatus: PreviewPreview

Status: NewNewStatus: PreviewPreviewSkills you'll gain: Capital Expenditure, Financial Modeling, Financial Analysis, Revenue Forecasting, Business Valuation, Financial Statement Analysis, Financial Statements, Financial Forecasting, Depreciation, Cash Flow Forecasting, Balance Sheet, Annual Reports, Sales, Working Capital, Microsoft Excel

Mixed · Course · 1 - 4 Weeks

Status: Free TrialFree TrialI

Status: Free TrialFree TrialIIntuit

Skills you'll gain: Inventory Accounting, Inventory Control, Depreciation, Fixed Asset, Property Accounting, Financial Accounting, Asset Management, Accounting, Financial Statements, Lease Contracts, Accounting Records, Bookkeeping, Income Statement, Balance Sheet, Capital Expenditure, Operating Expense

4.4·Rating, 4.4 out of 5 stars1.3K reviewsBeginner · Course · 1 - 4 Weeks

Status: NewNewStatus: Free TrialFree TrialU

Status: NewNewStatus: Free TrialFree TrialUUniversity of Cambridge

Skills you'll gain: Accrual Accounting, Accruals, Financial Accounting, Financial Modeling, Accounting, Equities, Financial Market, Capital Markets, Financial Analysis, Sustainable Business, Depreciation, Financial Statements, Cash Flows, Loans, Profit and Loss (P&L) Management, Microsoft Excel, Strategic Decision-Making

Intermediate · Course · 1 - 3 Months

Status: PreviewPreviewU

Status: PreviewPreviewUUniversity of Lausanne

Skills you'll gain: Mergers & Acquisitions, Equities, Tax, Accounting, Accounts Receivable, Securities (Finance), Financial Market, Inventory Accounting, Asset Management, Financial Accounting, Depreciation, Corporate Finance, Profit and Loss (P&L) Management, Balance Sheet, Financial Statements, Financial Reporting, Revenue Recognition, Cash Flows

4.9·Rating, 4.9 out of 5 stars66 reviewsBeginner · Course · 1 - 3 Months

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Corporate Tax, Income Tax, Tax Laws, Liquidation, Tax Planning, Tax Compliance, Mergers & Acquisitions, Capital Expenditure, Organizational Structure, Depreciation, Business Analysis

Build toward a degree

4.7·Rating, 4.7 out of 5 stars247 reviewsIntermediate · Course · 1 - 3 Months

Status: NewNewStatus: Free TrialFree Trial

Status: NewNewStatus: Free TrialFree TrialSkills you'll gain: Financial Reporting, Generally Accepted Accounting Principles (GAAP), Financial Statements, Financial Accounting, Balance Sheet, Income Statement, Cash Flows, Revenue Recognition, Accrual Accounting, Inventory Accounting, Fixed Asset, Depreciation, Accounts Receivable

Mixed · Course · 1 - 4 Weeks

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Illinois Urbana-Champaign

Skills you'll gain: Inventory Accounting, Balance Sheet, Cash Management, Accounts Receivable, Financial Reporting, Depreciation, Financial Accounting, International Financial Reporting Standards, Generally Accepted Accounting Principles (GAAP), Accounting, Fixed Asset, Financial Statement Analysis, Ledgers (Accounting), Inventory Control, Asset Management, Investments, Internal Controls

Build toward a degree

4.7·Rating, 4.7 out of 5 stars228 reviewsIntermediate · Course · 1 - 3 Months

Status: PreviewPreviewÉ

Status: PreviewPreviewÉÉcole Polytechnique Fédérale de Lausanne

Skills you'll gain: Property and Real Estate, Real Estate, Market Dynamics, Commercial Real Estate, Real Estate Transactions, Business Valuation, Financial Analysis, Return On Investment, Economics, Capital Budgeting, Investments, Price Negotiation, Market Analysis, Finance, Consumer Behaviour, Competitive Analysis, Depreciation

4.7·Rating, 4.7 out of 5 stars260 reviewsIntermediate · Course · 1 - 3 Months

Most popular

Status: Free TrialFree Trial

Status: Free TrialFree TrialProfessional Certificate

Status: Free TrialFree TrialI

Status: Free TrialFree TrialIIntuit

Course

Status: Free TrialFree TrialT

Status: Free TrialFree TrialTTechnical University of Munich (TUM)

Specialization

Status: Free TrialFree TrialT

Status: Free TrialFree TrialTTechnical University of Munich (TUM)

Course

Trending now

Status: Free TrialFree Trial

Status: Free TrialFree TrialProfessional Certificate

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Pennsylvania

Course

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Pennsylvania

Course

Status: Free TrialFree TrialI

Status: Free TrialFree TrialIIntuit

Course

New releases

Status: PreviewPreview

Status: PreviewPreviewCourse

Status: PreviewPreview

Status: PreviewPreviewCourse

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of Cambridge

Specialization

Status: PreviewPreview

Status: PreviewPreviewCourse